General Electric: Don’t Ignore These Indicators (NYSE:GE)

[ad_1]

creisinger

On the morning of July 26th, before the market opens, the management team at industrial conglomerate General Electric (NYSE:GE) is due to report financial performance covering the second quarter of the company’s 2022 fiscal year. As we approach that time, there are a few key things that investors should keep a close eye out for. With the exception of the impending split up of the enterprise into three separate firms, perhaps nothing is more important when it comes to determining the company’s prospects in the future than these particular items. This is especially true as fears mount regarding a potential recession, as inflation hits multi-decade highs, and at a time when the company is still very much in the recovery phase from multiple years of lackluster results. The numbers the company posts will reveal a great deal about how the fundamental health of the company currently is. I would even go so far as to argue that this quarter, in particular, will end up being more important for shareholders than most quarters before.

Keep an eye out on its key segments

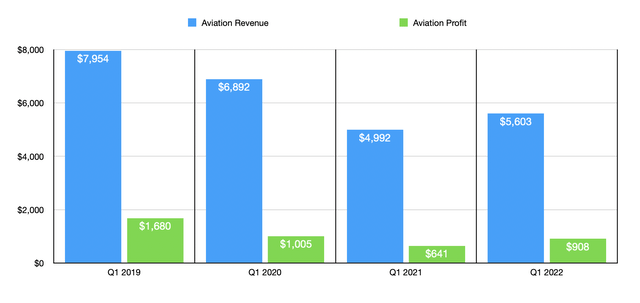

These days, General Electric operates in four key industrial segments. The most important of these, and the one that investors should keep the closest eye on, is the Aviation segment. For those not familiar with the conglomerate, Aviation focuses on the production of jet engines and other related parts. It also provides services dedicated to this space. Driven a couple of years ago by concerns over the Boeing (BA) 737 MAX aircraft line, and then after that by the fallout associated with the COVID-19 pandemic, this particular part of the company suffered significantly. In the first quarter of 2019, for instance, sales came in at just under $8 billion. By the first quarter of 2021, revenue had plunged to just under $5 billion. Profits went from $1.68 billion in the first quarter of 2019 to just $641 million the same time of 2021. The decline for the segment was driven in large part by a significant drop in the number of commercial engines delivered. In the first quarter of 2019, the company delivered 751 units. This fell to 359 units two years later. Over that same window of time, the number of military units dropped from 161 to 96.

Author – SEC EDGAR Data

The good news for investors is that the Aviation segment is showing some nice signs of recovery. Revenue in the first quarter of 2022 came in at $5.60 billion. That’s 12.2% higher than what the company generated one year earlier. Segment profits surged 41.7% from $641 million to $908 million. Of course, this improvement was not perfect. The number of commercial engines sold actually fell year over year in the latest quarter, dropping to 343. However, the number of military engines jumped to 184. Although this may seem disappointing, enplanement data provided by the TSA shows that air travel is truly coming back to life.

Author – TSA

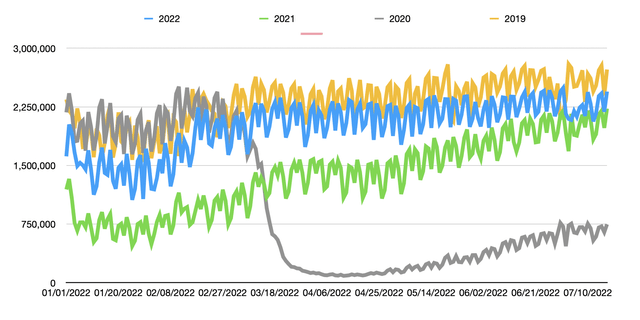

*Number of Enplanements Per Day

Using daily data from the start of the year through July 17th, total enplanements recorded by the TSA came in 107.3% higher than what they were in 2020. They were also 46.2% above the 2021 figures. However, they are still down 13.1% compared to 2019. The overall trend, however, is clear. As travel continues to open up, we can expect demand for aircraft engines to increase. Already, we are seeing some other positive signs on this front. According to one source, Qatar Airways recently ordered 60 passenger versions of the Boeing 777X and 14 freighter versions of it. They are also reportedly considering a larger order of these aircraft. These aircraft use the GE9X engine. Meanwhile, Delta Air Lines (DAL) recently placed an order for 100 Boeing 737 MAX 10 aircraft, which used the LEAP engine produced by General Electric. So, I would argue, this quarter might show continued strength for the segment compared to the $4.84 billion in revenue and the $176 million in profit the segment reported for the second quarter of 2021.

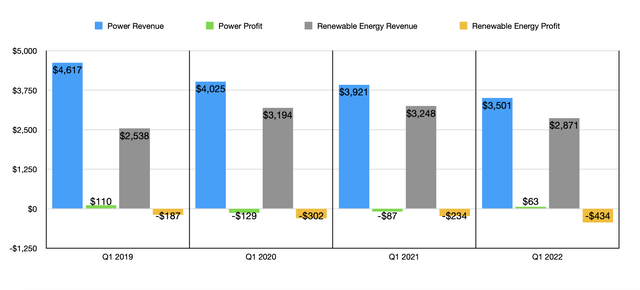

Though not as important for shareholders as the Aviation segment, investors should also keep a close eye on both the Power and Renewable Energy segments of the company. For years, the Power segment has been a problem for the enterprise as demand has fallen and operational inefficiencies have plagued the business. Back in the first quarter of 2019, for instance, sales came in at $4.62 billion and profits were $110 million. Although revenue continued to fall in the first quarter of this year compared to the same time last year, declining from $3.92 billion to $3.50 billion, profitability has started to improve. Significant cost cutting has turned the segment back to positive, with operating income in the latest quarter of $63 million. That compares to the $87 million loss achieved one year earlier and the $129 million loss seen the year before that. A more recent pain point for the company has been the Renewable Energy segment. Revenue in the latest quarter came in at $2.87 billion. That’s 11.6% lower than the $3.25 billion reported one year earlier. Over that same window of time, the operating profits for the segment went from a negative $234 million to a negative $434 million. Seeing some improvement for either or both of these segments could go a long way to pushing shares higher.

Author – SEC EDGAR Data

Backlog is important

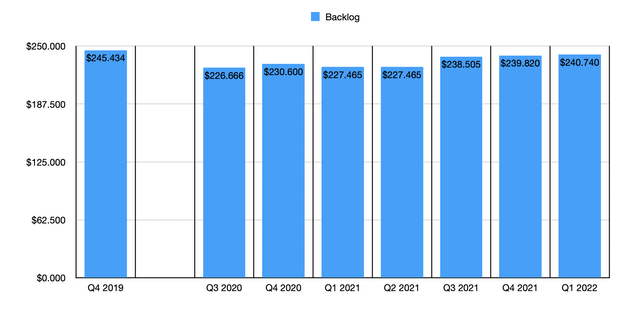

Although the data discussed so far will cover results that have already happened, there is one important leading indicator that investors should pay attention to. And that is backlog. Due to the COVID-19 pandemic, backlog for the company had fallen quite a bit. But recently, we have seen some improvement on that front. At the end of 2019, this figure had been $245.4 billion. It ultimately plunged after that, hitting $226.7 billion in the third quarter of 2020 Before rebounding quite a bit. By the end of 2021, the metric had risen to $239.8 billion. And in the first quarter of this year, it ticked up slightly to $240.7 billion. There is no telling what this metric will come in at during this upcoming quarter, especially given the uncertain economic situation and high inflation. But there is no doubt that an increase in backlog will be a net positive for the company.

Author – SEC EDGAR Data

Debt and cash flows are both important

One thing that General Electric has suffered with in recent years has been cash flow. Fortunately, that picture is already changing. In the first quarter of its 2022 fiscal year, for instance, the business generated operating cash flow of negative $535 million. Although this may not seem great, it does mark a significant improvement over the negative $2.64 billion generated the same time one year earlier. If we adjust for changes in working capital, however, cash flow would have risen from $664 million in the first quarter of 2021 to $699 million the same time this year. One thing that is certain is that the company will definitely need to see some improvement in the second quarter if it is to achieve its targets for free cash flow this year. The current forecast is for this metric to be between $5.5 billion and $6.5 billion, with the metric ultimately climbing above $7 billion in 2023.

If the company can achieve this, then there is a chance that debt could fall. To be fair, net debt for the company is not all that high anymore. Various asset divestitures have seen to that. As of the end of the latest quarter, net debt totaled $10 billion. That was up from the $7.1 billion reported just one quarter prior to that. While the overall debt situation for the company is pretty solid, it would be nice to see this figure drop further. After all, the lower that leverage is, the lower the risk profile of the company is. And that could be particularly important if economic circumstances do worsen from here.

Takeaway

As we near the second quarter earnings release for General Electric’s 2022 fiscal year, the general picture for the company is mostly looking up. Management has done well so far to improve the company, but it is still definitely in a stage of recovery. That makes the company particularly vulnerable and subject to wild swings in share price. More importantly, the metrics I outlined in this article warrant monitoring because they will be the first to indicate exactly how healthy the company is and how healthy it’s becoming.

[ad_2]

Source link