Bankman-Fried’s ‘I screwed up’ script about penalties vs. jail: Lawyer

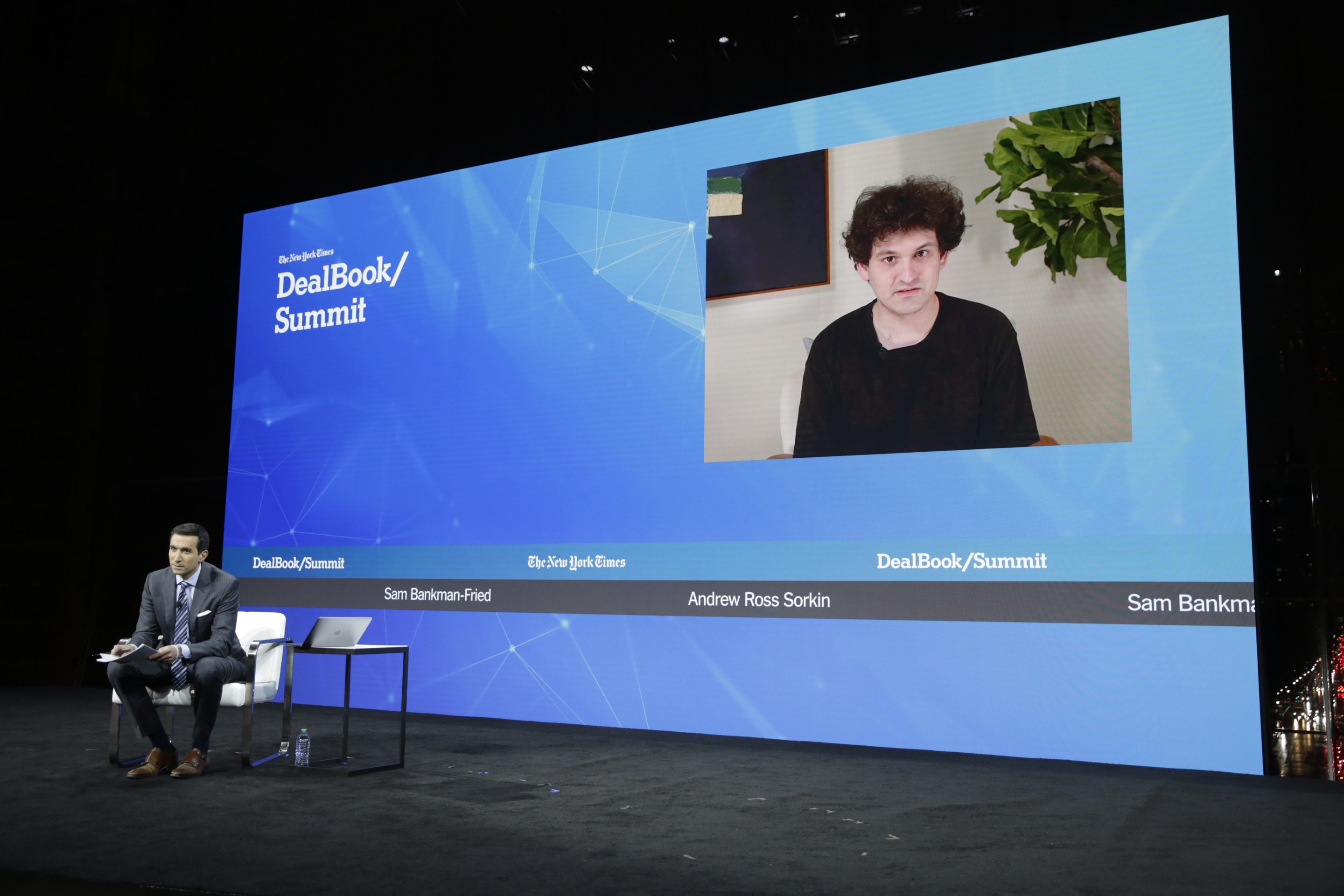

FTX founder Sam Bankman-Fried went on an “I screwed up” media blitz this week, highlighted by his movie look at the New York Situations DealBook summit on Wednesday and continuing into the Sunday talk demonstrates.

U.S. securities law firm James Murphy, speaking to CNN’s Quest Signifies Organization on Thursday, claimed Bankman-Fried “did a incredibly fantastic work of sticking to his chatting points.”

Murphy stated: “His speaking points have been, ‘I did not do just about anything erroneous deliberately. I could have been negligent. I may well have breached fiduciary obligations.’ But all those two factors get you sued, get you penalized. They do not get you to jail. And so he steered crystal clear of nearly anything that sounded like intentional misconduct.”

FTX imploded in breathtaking fashion final month, spurring phone calls for tighter regulation and shaking self-assurance in the crypto sector. The $32 billion cryptocurrency exchange experienced recognized by itself as a chief in the field, enlisting star athletes like Stephen Curry and other celebrities to bolster its impression.

A critical accusation leveled versus Bankman-Fried is that he used purchaser resources from his crypto trade to fund risky bets at affiliate investing arm Alameda Investigate.

‘Did not ever consider to commit fraud’

In the DealBook job interview, Bankman-Fried peppered his statements with legalese, stating that he “did not at any time try to dedicate fraud on everyone,” didn’t “know of situations when I lied,” and “didn’t knowingly comingle resources.”

Said Murphy of Bankman-Fried sticking to the script: “He’s a pretty, really vibrant person and managed to do that for an hour.”

In a Financial Moments job interview posted Sunday, Bankman-Fried stuck with the theme, expressing, “I f****d up huge and people bought damage.”

On ABC’s This 7 days on Sunday, Bankman-Fried stated, “Look, I screwed up. Like I was CEO, I experienced a responsibility in this article and a accountability to be on top of what was going on the exchange. I wish I experienced finished substantially far better at that.”

ABC legal analyst Dan Abrams explained afterwards, “His simple protection, it sounds like, is, ‘I did not have the intent. I wasn’t making an attempt to do it.’ That is not sufficient in a ton of circumstances. That is not likely to secure him automatically from obtaining indicted. But it is anything we hear from CEOs who get tried, and it pretty much by no means is effective.”

‘People will go to jail, and should really go to jail’

Abrams extra that Bankman-Fried could be facing a very long time in jail.

“We’re talking about, by the way, the probability of up to lifestyle in jail,” he said. “When you are talking about this significantly money, in the federal sentencing suggestions, you’re chatting about the likelihood of enhancement immediately after improvement following improvement centered on the greenback quantities that could lead to a little something up to daily life.”

Previously this 7 days Coinbase CEO Brian Armstrong explained of Bankman-Fried, “It’s “baffling to me why he’s not in custody by now.”

Mark Cuban, billionaire operator of the Dallas Mavericks and a outstanding crypto investor, a short while ago advised TMZ that Bankman-Fried ought to be fearful about jail time.

Mike Novogratz, CEO of crypto business Galaxy Digital Holdings, explained to Bloomberg Television on Thursday, “Sam and his cohorts perpetuated a fraud…He took our money. And so he needs to get prosecuted. Individuals will go to jail, and should go to jail.”

Securities law firm Murphy added that prosecutors really do not have to verify that there was securities fraud. “They can go with mail and wire fraud,” he said. “If the money of consumers was misappropriated and offered to this affiliated organization Alameda, that is a fraud and must qualify below the statues. I sincerely hope our Section of Justice is looking at it really tough.”

Fortune achieved out to Bankman-Fried for feedback but did not get an speedy reply.

Our new weekly Impression Report newsletter will examine how ESG information and trends are shaping the roles and obligations of today’s executives—and how they can very best navigate those issues. Subscribe here.